Note: The forecasts contained within our data were formed just prior to the COVID-19 crisis. However, our analysis covers a long-term outlook of ten years and so we feel that the final rankings and analysis will still hold over that longer period.

The rise of the private rented market and the increasing proportion of households moving into this sector has been clear for some time now. The English Housing Survey has long been showing the rising trend of private renters, moving from around 9.2% of households in the early 1990s to a peak of 20.3% in 2017. Although the last two years has seen a small movement downwards, there is still an estimated 4.5 million households privately renting (2019, latest data). So although the BPF indicates that there are around 43,236 build to rent units completed across the UK, with a further 33,505 under construction (around half of which are located outside of London), the reality is that most in this sector live in accommodation that is piecemeal and dominated by private individual landlords and small management firms.

The attraction of the build to rent model is clear, from both the developer’s perspective (long-term and stable income stream) and the tenant side (longer tenancies, streamlined experience, direct-to-reach management). It is easy to see why it has emerged with particular fervour over the last five or so years, at a time when households were looking to the private rented sector as an alternative to what has been increasingly unaffordable home ownership.

In early 2020 we published our first Build to Rent article where we examined where the best opportunities for build to rent (BTR) schemes were across the South East and parts of the East . In it we discussed the five measures we used to analyse what locations would be a current best fit for BTR: household population, proportion of private renters, affordability, yields and average house prices (affluence), with a further three ‘future’ measures for looking ahead: household growth, employment growth and future house price growth.

In this latest article we look again at the same 114 locations and the same eight measures, with timely and updated data but rather than looking at the best fit currently versus the best fit in the future, we combine the measures, weighted with the same level of importance, to determine what could be considered the best locations for a build to rent opportunity.

Top 10 locations

|

Rank

|

Location

|

Weighted score

|

|

1

|

Brighton and Hove

|

135.8%

|

|

2

|

Reigate and Banstead

|

116.5%

|

|

3

|

Watford

|

115.6%

|

|

4

|

Eastbourne

|

115.3%

|

|

5

|

Canterbury

|

115.1%

|

|

6

|

Worthing

|

113.2%

|

|

7

|

Milton Keynes

|

112.9%

|

|

8

|

Slough

|

112.7%

|

|

8

|

Elmbridge

|

112.7%

|

|

10

|

Colchester

|

112.6%

|

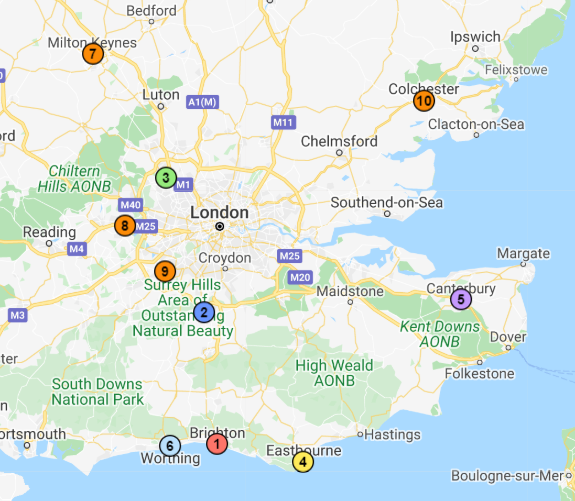

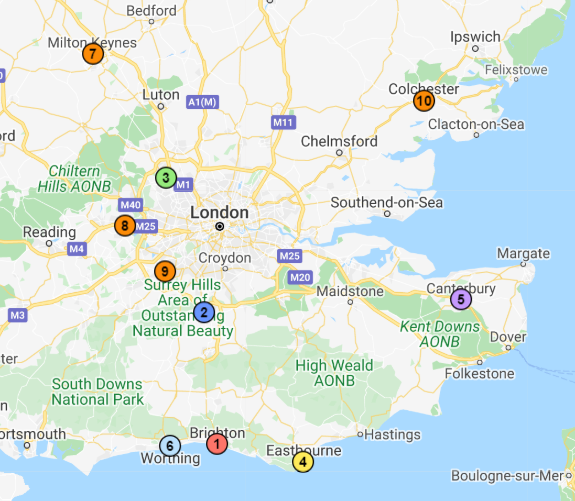

It is interesting to note that none of these locations form a ‘bubble’ of opportunity, with the ten locations scattered across the South East and East. Below, we look at the top five locations in detail, what makes them stand out and how they might be unique places for a build to rent opportunity.

We have highlighted some areas with strong potential, but this doesn’t mean there aren’t opportunities elsewhere. The prospects for this sector are favourable and it will be relatively resilient in the current downturn. Underlying structural drivers such as continued population growth, a chronic undersupply of housing and a shift in attitudes by younger people drawn to the flexibility of renting, will continue to make this sector attractive through the long term.