Central London Net Effective Rents Monitor Q4 2023

The Carter Jonas Net Effective Rents Index

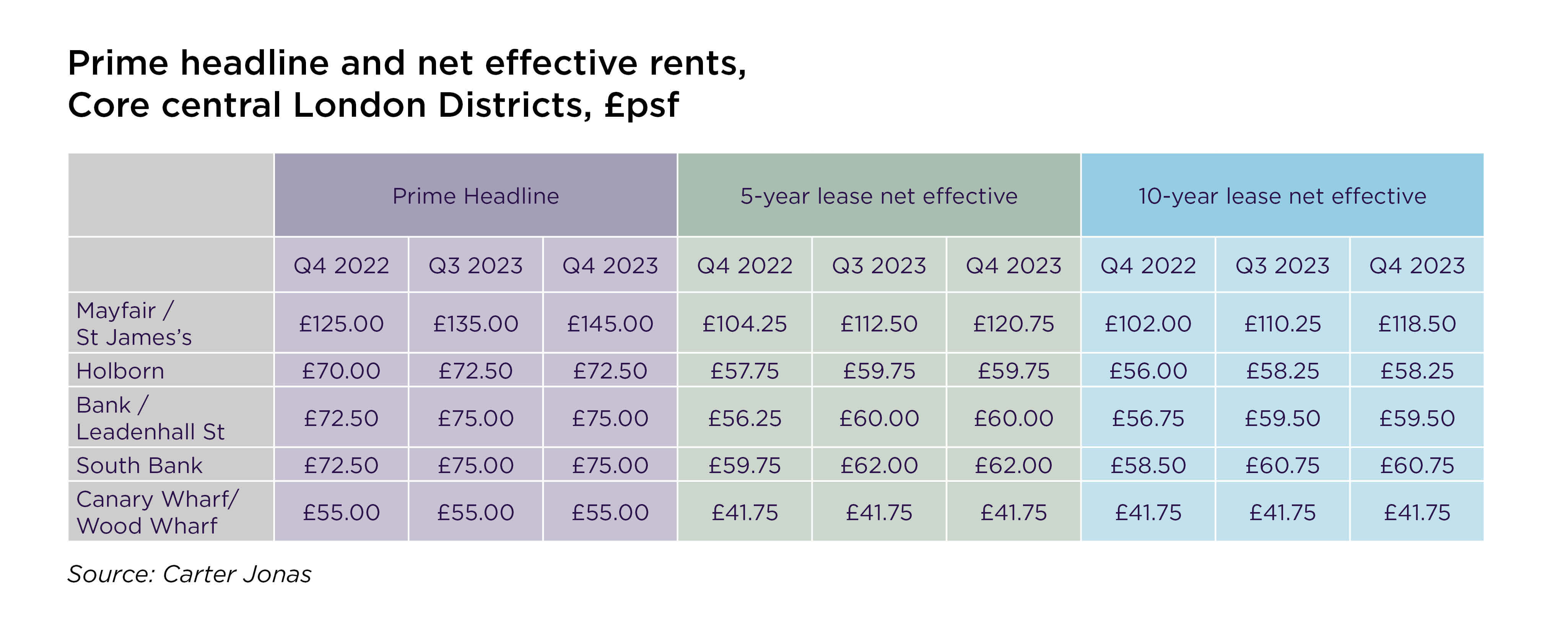

Our Central London Net Effective Rents Monitor illustrates the combined impact of changes to both headline rents and the typical length of rent free periods across 22 central London districts.

The Index also reflects different lease lengths by providing analysis of five and ten year leases, which can have a significant impact on the net effective rent for each district.

Note: the impact of the timeframe for the ingoing tenant to carry out its fitting out works has not been factored into the Carter Jonas net effective rent analysis simply because the timeframe will be influenced by the quantum of space to be leased.

Overall central London trend

2023 was characterised by a shortage of high quality office stock in many, though not all, central London districts, and this has continued to favour landlords in lease negotiations. However, the market is highly nuanced, with each district having its own supply and demand characteristics. In our Q4 2023 central London Net Effective Rents Monitor, we examine the overall central London trend for prime headline and net effective rents, plus key variations at district level. We look at the West End submarket in particular detail, where supply is the tightest and rental growth is focussed.

Figure 1 illustrates prime headline and net effective rents for central London offices since 2018. As is typical during the cycle, landlords reacted to the pandemic-induced downturn by increasing incentives rather than reducing headline rents. As a result, prime headline rents fell only modestly compared with prime net effective rents. Now that rent free incentives have recovered post-pandemic, the focus of landlords has reverted to pushing up headline rental levels (given that the value of commercial property investments is more sensitive to the level of headline rents than the quantum of rent free period incentives).

Figure 1

Source: Carter Jonas, RCA, CoStar

The prime central London headline rent recovered to its pre-pandemic level by the end of 2022, and now sits 3.8% above its pre-pandemic peak. During 2023, prime headline rental growth across central London was 2.5%. The West End submarket was the main driver in 2023 (averaging 8.8% across the various districts), with some modest growth in Midtown (averaging 1.6%). Looking at the change during Q4 2023, the prime central London headline rent increased by 1.3%. This was entirely driven by the West End submarket, with no change reported in Midtown, the City or East London/Docklands.

Although market conditions mainly impacted headline rents, 2023 saw some limited reduction in typical rent free periods offered by landlords in high-demand locations where top quality space is in particularly short supply. Here, we have seen reductions of around 1 – 2 months for a 5 – 10 year lease. The prime central London net effective rent increased by 2.6% in 2023 (assuming a five-year lease), and now sits 1.6% above its pre-pandemic peak. Typical rent free periods remained static during Q4 2023 across central London.

It is important to note that our figures reflect top quality, well-located grade A space. Headline rents and rent free period incentives for low grade office space with poor environmental credentials have shifted little over the last twelve months.

Focus on the West End

It is in the West End submarket where the most significant changes to rental levels are occurring, reflecting the ongoing demand / supply imbalance in many key locations.

In the core West End districts of Mayfair/St James’s, where occupier demand is most heavily concentrated, very little high quality stock is immediately available. This lack of supply resulted in a 16% increase in prime headline rents during 2023, with typical rent free periods remaining low at just 8 – 12 months (assuming a five-year lease). The prime headline rent in Mayfair/St James’s sits at £145 per sq ft per annum in Q4 2023 (up from £135 per sq ft in Q3 2023), as reflected across several lettings in and around Grosvenor St and Davies Street. It should be noted that higher rents of £180+ per sq ft per annum are being achieved in the prime locations of Berkeley and St James’s Squares, but these are not reflective of the wider Mayfair/St James’s district.

Elsewhere in the West End, Victoria/Westminster has the advantage of a greater availability of buildings with large floorplates. The prime headline rent for this district is now £85.00 per sq ft per annum (Q4 2023), up significantly from £78.50 per sq ft in Q3 and £77.50 per sq ft a year ago (representing an annual increase of 9.7%), although rents of around £90 per sq ft are now being achieved on the upper floors of new and refitted buildings.

The district of Soho is also benefitting from the ‘ripple effect’, with demand displaced from more core districts including Mayfair and St James’s, due to the lack of supply. Land Securities’ Lucent scheme (110,000 sq ft of office space plus retail and residential) has benefited from this trend and the lack of competition has seen it achieve rents of circa £125 per sq ft per annum on the upper floors, and within a range of £105 – £115 per sq ft on the lower floors. We regard the prime rent reflective of the wider Soho market as being £105 per sq ft per annum, although this is now pushing towards £110. The prime rent in this district has risen by a remarkable 13.5% over the last 12 months.

Paddington, too, has seen the letting of new developments in the second half of 2023 set higher benchmark rents, with the prime headline rent now standing at £82.50 per sq ft per annum, up from £80.00 per sq ft in Q3 2023 and £77.50 per sq ft at the end of 2022, an annual increase of 6.5%.

White City has seen headline rents creep up, boosted by its location as a centre of excellence for the life sciences, pharmaceutical, technology and media sectors. Imperial College’s Wood Lane campus has underpinned demand from businesses that have a connection with the University’s research activities. The prime headline rent is now £55.00 per sq ft per annum, up by 3.8% over the last year. This contrasts with Hammersmith, where demand remains weak due to its more peripheral location, and headline rents were static during 2023.

The tightening demand / supply balance in these West End districts was largely reflected in rising headline rents during 2023.

Figure 2

Source: Carter Jonas, RCA, CoStar

Figure 3

Source: Carter Jonas, RCA, CoStar

Table 1

Figure 4

Source: Carter Jonas, RCA, CoStar

Outlook

The first half of 2024 will be challenging for occupational demand, with subdued economic and employment growth. The ongoing highly competitive labour market will continue to constrain demand and focus attention on the highest quality space to boost recruitment and retention rates. The central London office market will therefore be driven by the changing nature of demand rather than the quantum of it. We expect to see these conditions reflected in weaker take-up levels during the first half of this year, compared with 2023. However, it is interesting that we are now also seeing fewer occupiers looking to downsize.

Despite occupier demand levels running below long-term averages, headline rents and typical rent free periods will be underpinned by the lack of high quality supply in many districts. Whilst we are likely to see broadly static headline rents and rent free periods for grade A office space across much of central London during the first half of 2024, prime locations in the West End may well prove to be an exception. Here, advertised rents for new, best in class, grade A space are likely to rise further, with a further modest contraction in rent free periods of perhaps one month also possible. Conversely, it is also possible that some central London districts where there is a better balance between supply and demand in the grade A market could see a modest expansion in typical rent free periods, although headline rents for space with good green credentials should hold up almost across the board.

Overall, therefore, net effective rents for grade A office accommodation are likely to push on further in the core West End districts of Mayfair and St James’s during 2024, with potential for some further growth elsewhere in central London, focussed on the West End submarket.