- Date of Article

- Feb 03 2017

Keep informed

Sign up to our newsletter to receive further information and news tailored to you.

• Sales still achieving 5% above guide price in “hotspots”

• European buyers take advantage of currency devaluation

The UK’s rural sector has emerged from the political and economic unrest of 2016 relatively unscathed, according to Carter Jonas, the national property consultancy.

With sentiment largely positive, demand for rural property has remained strong throughout the past twelve months. Although a new demographic of investor is now looking at rural property as an option to diversify their portfolios, local buyers still have a dominant presence in the market. Carter Jonas also recorded an increase in the number of enquiries from lifestyle buyers in the North West and Western regions over the course of the year.

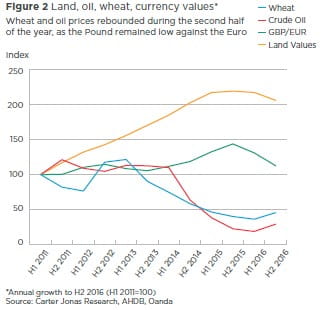

Figures show that arable land values modestly declined by 5.2% in 2016, reflecting a natural cooling of the market rather than a specific reaction to the results of the Brexit vote. Even against the backdrop of a market correction, regional hotspots were seen within Oxfordshire, Gloucestershire and Yorkshire, outperforming the national position.

Settling at a UK average of £10,500/acre by the year-end, European buyers of arable land have benefited from the Brexit-induced currency devaluation of sterling, making such assets especially appealing.

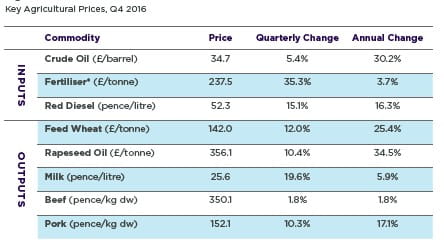

Output commodity prices are also benefiting from the weakened pound, having significantly increased during the last quarter of 2016. Feed wheat, valued at £142/tonne at the end of the year, recorded positive annual growth for the first time since 2012, while the price of milk increased by nearly 20% in the last quarter.

Input commodity prices saw a marked increase in December, having fallen throughout the first three quarters of the year, rebounding back to levels last recorded in mid-2015. Fertiliser (ammonium nitrate) values, in particular, reached £237.5/tonne, up 35.3% on the last quarter.

Tim Jones, Head of Rural, Carter Jonas, comments;

“As we progress into 2017, it is clear that the rural sector has a defined and vital role to play in the security and growth of the UK’s economy. We need to be prepared for the period of change which lies ahead and adapt our business models accordingly.”

Andrew Fallows, Head of Rural Agency, Carter Jonas, comments;

“After a promising summer and autumn, with sales in hotspots achieving 5% above guide price, we are confident that rural assets still represent a solid investment for any portfolio.

“While land owners might be adopting a “wait and see” approach to business, purchaser demand – utilising rollover relief following development land sales - has remained high. After a turbulent year, we should be encouraged that the sector has successfully weathered the storm of 2016.”