Our research experts, collaborating with our strategic land professionals, have produced an easily digestible video to reflect on the current key drivers and impacting factors within the strategic land sector.

The piece reviews future land allocations, housing need data, property price trends, and overall forecasts.

Strategic land analysis video

Presented by our Head of Research, Daniel Francis, and created with one of our strategic land professionals, Francis Truss, the short video below discusses the findings of our latest strategic land research.

For further information on the strategic land market, or to speak to a property specialist, please contact us.

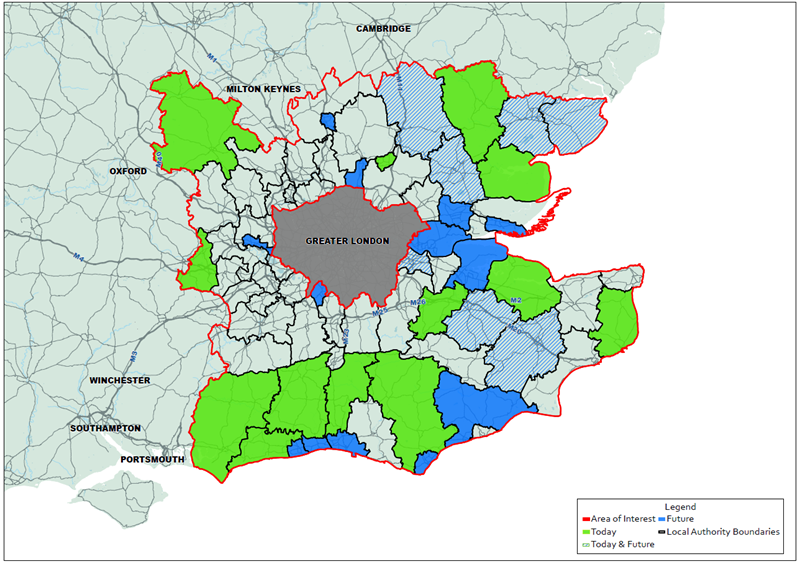

In the home counties, where should you invest in strategic land?

The map below outlines opportunity areas for strategic land, both now and in the future, based on our analysis of economic and property market data. Essentially, identifying which local authority districts could provide the greatest returns for those wishing to invest in strategic land. View the video above to find out more about the results.

How have we reached our conclusions?

Below we outline the investment decision factors which have led to our conclusions on the top 20 locations to invest in strategic land around London. To reach these decisions we have considered several essential factors, including infrastructure investment, employment growth, Green Belt land and the historic commitment of each local authority housing delivery.

|

FACTOR |

METRIC |

EXPLANATION |

|

TODAY |

||

|

Local Authority commitment to delivery |

Five-year housing completion rates relative to existing housing stock and objectively assessed need |

We have been looking for districts with strong housing absorption rates and ‘pro-active’ Local Authorities |

|

Desirability of the location |

Affordability |

Where locations are highly desirable, there is ‘pent-up’ demand, therefore presenting an opportunity |

|

Increased housing demand |

House Price Index data |

In some areas, the momentum in house prices may not have fed through to the strategic land market yet, presenting an opportunity |

|

Low risk of planning permission being declined |

Limited Green Belt |

In districts with considerable Green Belt land, housing completion rates decline. Which is why, districts with limited Green Belt could be more desirable for some strategic land investors |

|

FUTURE |

||

|

Significant planned infrastructure investment |

Crossrail 1 & 2, East West Rail and Housing Infrastructure Fund |

Studies of previous implemented infrastructure suggests that house price growth and deepening demand is a key result of planned infrastructure investment |

|

Potential for the diversification of tenures |

Build to Rent potential |

For large sites, diversifying tenures is becoming increasingly important in a planning sense and could provide resilience through market cycles |

|

Employment growth |

Five-year Government forecasts (Office for National Statistics) |

Employment growth is a major factor in determining policy levels of housing need and driving demand, therefore indicating future opportunities |

|

House price growth |

Five-year UK House Price Index forecast |

House price growth is a key indicator of localised housing demand |

Please note:

Even weightings are applied to the respective metrics.

Data is from January 2020 (and prior to the creation of the unitary Buckinghamshire Council authority).

Commentary on ‘demographics’ within the video relates to Experian sector analysis.

For further information on the strategic land market, or to speak to a property specialist, please contact us.