The valuation of property stands at the heart of all property decision making; hence it is a core part of our practice. Carter Jonas has a comprehensive network of over 100 RICS Registered valuers across the country to advise our clients.

Our valuation teams provide specialist advice in their fields and a balanced, market led approach, aided by up to date market knowledge from our agents and extensive market contacts.

Our valuation sectors

We have experts in a breadth of property sectors and specialist areas, including:

- Affordable housing

- Civic

- Commercial

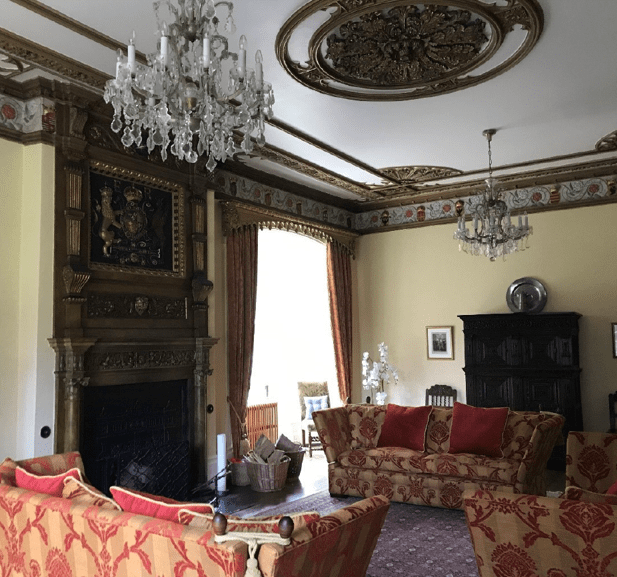

- Country houses

- Farms and land

- Education

- Energy

- Equestrian

- Garden centres & nurseries

- Healthcare & senior living

- Landed estates

- Leisure

- Leisure parks

- Industrial

- Marinas

- Medical

- Minerals & waste management

- Mixed asset portfolios

- Residential

- Retail

- Rural estates

- Rural leisure

- Serviced offices

- Strategic land

- Student accommodation

- Telecoms

- Transport

- Utilities

Our national network of offices ensures we can offer our UK clients a national service with local knowledge. We also have a solid track record in providing independent and objective advice to some of the world’s largest and fast growing corporations as a member of the PRAXI Valuations international network. PRAXI Valuations provides independent valuation and advisory services to clients in the real estate, loan valuations and due diligence fields.