- Date of Article

- Sep 19 2017

- Written by

- Leslie Schroeder

- Sector

- Residential services

Keep informed

Sign up to our newsletter to receive further information and news tailored to you.

The date either resonates with you, or you’re scratching your head trying to think what is significant about it. It’s also possible that if you’re not in the residential property industry you may not even care.

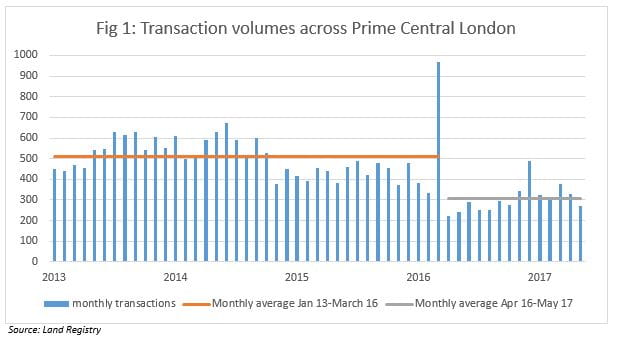

Or, as it turns out, your location may play a part. Londoners, ‘South Easterners’, investors, and property analysts, will have probably noticed that since April 2016 – the date upon which the new 3% stamp duty surcharge on second homes and buy to let investments took effect – the transactional environment in the residential property market has degenerated. In some areas much more significantly than others. Just take a look at the hard data in Figure 1 – between January 2013 and March 2016 and April 2016 to May 2017 average monthly transactions in the prime central London resi market have declined by over 40%!

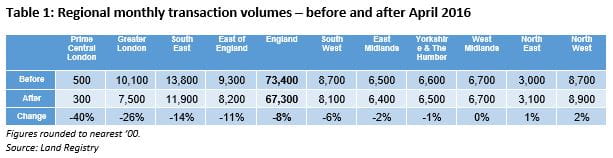

What is even more compelling is that the picture is so different across different parts of the country. In Table 1 we show the average monthly transactions before the stamp duty increase versus after the stamp duty increase, and the comparative change this has had. By some margin Prime Central London and Greater London have felt more of an impact than all other English regions, even significantly more than the wider South East.

Clearly the buy-to-let market has been impacted. Indeed data from UK Finance shows that by May this year buy to let mortgages were 44% below the same time last year (12 month rolling total); compare this with first time buyer mortgages which increased 8% over the same period.

Is it possible then that the buy to let market is disproportionately represented in London and the South East? Perhaps, but consider this: investors have been hit twice, not only by the 3% additional surcharge on buy-to-let investments, but the phased introduction this year (from April 2017) of changes to tax relief whereby landlords will no longer be able to deduct all of their mortgage expenses from their rental income to reduce their tax bill. This will impact only higher-rate taxpaying landlords but perversely could also push some landlords INTO the higher-rate or additional-rate tax bracket. And at the risk of sounding ‘regionalist’, this consequently and disproportionately affects Londoners most since incomes in the city tend to be higher (ironically, to off-set the higher cost of living). In London at least, a picture of the numbers is worth a thousand words...