RESIDENTIAL MARKET AND OUTLOOK

Latest house price data from the major indices of Halifax and Nationwide point to some (perhaps unsurprising) discrepancies in both trajectory and ‘regularity’ of the current housing market. Nationwide reported May price growth of 1.8% followed by a June decline of 0.1% (annually). On the other hand, Halifax has reported annual increases of 2.6% and 2.5% over the last two months, respectively. A commonality between them has been the month on month price declines but again there are wide gaps between the figures with Nationwide’s latest figure of -1.8% comparing with Halifax’s rather small fall of 0.1% in June. These varying figures point to the difficulties in creating a rounded and coherent view of the market, at a time of much lower-than-normal transaction activity. Over the short-term we expect these discrepancies between the indices to continue as activity remains not just lower than usual but sporadic and uncertain as buyers and sellers try to navigate pricing in the current climate.

In the weeks immediately following the reopening of the housing market, latent demand that had built up during the restrictions meant there was a surge in enquiries, valuations and offers. Rightmove reported unprecedented demand on their website and our Carter Jonas offices saw enquiry levels soar. Although these strong numbers of enquiries and offers may not hold to quite such levels as the weeks and months go on, we do expect demand to remain reasonably strong as buyers and renters look to ‘new ways’ of living and new areas to live in, now that lockdown has opened their eyes to different ways of living and working.

Robust levels of demand however have not been met with an equal rise in new supply. This difference in supply and demand has kept pressure on prices and we have not seen any significant decline in prices on an annual basis. While there has been some downward pressure on pricing month on month (Nationwide), much of this will have been people reassessing offers made pre-lockdown.

Despite the reopening of the housing market in mid-May, mortgage approvals (Bank of England) and transaction activity (HMRC) were both subdued during the month. Clearly there is a lag in mortgage approvals and transactions so May data may not be the best indicator of recovery. However, with unemployment levels expected to increase during the year, wage growth subdued and general economic confidence quite muted, there is no great expectation that the housing market and transactions will return to ‘normal’ levels anytime soon.

In early July, the Chancellor announced a temporary stamp duty holiday on all house purchases on the first £500,000. Effective 8 July 2020 – 31 March 2021, the suspension means that anyone completing on a main residence costing up to £500,000 will not pay any stamp duty, and more expensive properties will only be taxed on their value above that amount. This will undoubtedly increase activity levels as people look to ‘cash in’ on the savings they will achieve by purchasing during this period, and with lenders now looking for higher deposits, this will also go some way to helping offset this increase. The last time there was a stamp duty holiday (Sept 2008-Dec 2009) transactions rose by over a third, and we expect a similar rise during this period.

Across the lettings market, the last three months have seen a virtual standstill in terms of rent rises, as many landlords did not increase rents as they recognised the current financial difficulties facing many tenants during the COVID-19 crisis. ARLA Propertymark reported just 14% of landlords increased rents during May 2020, compared with over 45% the same time last year.

Looking ahead, we continue to believe that the lettings market is still fairly insulated from the worst of the economic effects of the COVID-19 crisis. Even before the crisis many private landlords were departing the sector with many areas finding demand outstripping supply already. Going forward there may be even more landlords who will be forced to quit the sector as they find themselves victims of rent arrears during the crisis. These tightening supply levels will, perversely, keep rent levels and rent rises sustained.

In the Central London lettings market however, applicant demand has been low during the COVID crisis, very much different to what the rest of London and the regions are experiencing. We believe this relates to overseas applicants and students who are not currently looking for rental properties. This will likely improve over the short-term however, as travel begins to open up, and the international community returns.

Economic outlook

The impact of the COVID-19 pandemic and lockdown on economic growth has already proven to be substantial, but the length and depth of the downturn is still highly uncertain, and is largely dependent on external factors, including the path of the virus globally; the extent to which it can continue to be suppressed in the UK; and the success of ongoing policy interventions on social distancing, fiscal and monetary policy and other stimulus measures. The path to normality will not be straightforward; further local lockdowns are almost inevitable, and the risk of a broader based second wave of the outbreak is very real. Looking further ahead, the speed with which the bioscience sector can develop and mass-produce a vaccine and / or medication to assist recovery is a key unknown.

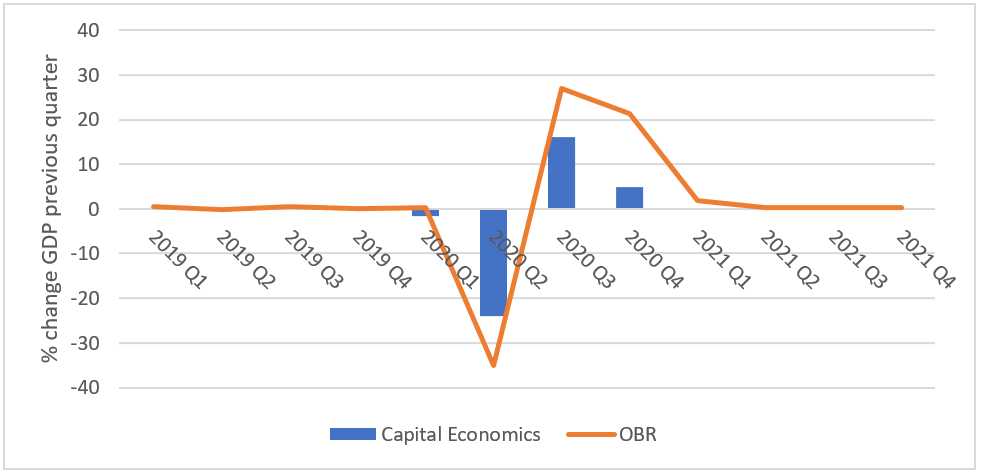

We can say with near certainty that the fall in UK output in Q2 will be by far the largest recorded in modern economic history with declines of up to -35% during Q2 (OBR) forecast, before an increase of 27% and 21% during Q3 and Q4, respectively. The June Consensus forecasts suggest a fall in UK output of -9.2% for this year, followed by +6.5% next year. Any forecasts are highly speculative at present, but this suggests a return to pre-COVID-19 output in 2022. Much will depend on the level of economic "scarring”, where output is permanently lost through rising unemployment and business insolvencies, limiting the speed with which recovery can occur. The global context is also important – in June, the IMF reduced its forecast for global growth this year to -5%, compared with the -3% it expected in April.

Prior to the crisis, UK employment was at a record high and unemployment at a record low. The COVID-19 crisis has been a huge disruptor, with nearly 9 million employees currently furloughed (over a quarter of the workforce) and 2.6 million claims have been made under the Self-Employed Income Support Scheme. In addition, millions of employees are working at home rather than their usual workplace. There is a significant lag between the official unemployment statistics, which only cover the period up to the three-months to April, with the unemployment rate still reading 3.9%. However, the total number of hours worked fell by 8.7% compared with previous three months. In the period March-May, job vacancies saw a record fall of 342,000 compared with the previous three months.

The furlough scheme is due to wind down in stages, with employers required to contribute a rising share of wages until the scheme ends in October. Further Government support measures were announced in July, most notably the Job Retention Bonus (a one-off payment of £1,000 to employers for every furloughed employee continuously employed until the end of January 2021), but there is a limit to what these can achieve. A recent YouGov survey found that 51% of businesses intend to make redundancies within three months of Furlough expiry, and only a third felt confident that all their staff would be kept on.

Unemployment will rise significantly despite Government support, and a wave of recent corporate announcements on job losses are a sign of things to come. The current consensus forecasts suggest the unemployment rate will reach 7.9% by the end of the year.

Public sector employment is largely unaffected, a key difference to the austerity of the Global Financial Crisis. Indeed, the public sector has been hugely stretched in dealing with COVID-19, and will probably be considerably larger after the crisis, as some industries will require long-term government support. However, many parts of the public sector are now under severe financial pressure. This includes local councils, and the Government has announced a package of support measures.

As restrictions are eased, the Government has the unenviable task of balancing public health risks with the need to stimulate the economy. In England, most hospitality venues and some personal care outlets were able to reopen from 4th of July. However, the need to be “COVID-secure” and continued social distancing means this will be far from business as usual. Some businesses may simply not be able to operate at profitable levels and therefore may not re-open. Government support announced in July is designed to entice customers back to restaurants and bars. The “Eat Out to Help Out” scheme which will entitle diners to a 50% discount of up to £10 per head at participating venues on certain weekdays during August; and a reduced rate of VAT (5%) will apply until 12 January next year.

Co-ordinated action between the central banks of the major advanced economies to lower interest rates and boost the money supply has been a key part of the global response. This has been in sharp contrast to a highly disjointed global political response. The Bank of England cut interest rates to an all-time low of 0.10% and has injected £310m of quantitative easing into the economy since the start of the crisis, with more likely to follow.

Inflation has fallen sharply, with CPI now at 0.5% (May 2020), well below the Bank of England’s target rate (2.0%). It is likely to fall a little further and could record a figure close to zero (with some very mild deflation possible) in the coming months before rising again. The Consensus forecast suggests it will be 0.7% at the end of this year, and 1.6% by the end of 2021.

With confirmation that there will be no extension to the transition period, Brexit has significant potential to hold back UK recovery, although there will probably be an interim solution if a deal is not agreed by this autumn. There will also be a host of other long-term implications from COVID-19, which are unknowable at this stage, although the following sections suggest some areas to consider across the commercial sectors.

Proposals for comprehensive reform of the entire planning system will be set out later this month. This has the potential to be an important tool in responding to the immense structural change now under way.

Note: Consensus forecasts refer to the comparison of independent forecasts for the UK economy, compiled by HM Treasury.