- Date of Article

- Aug 09 2016

Keep informed

Sign up to our newsletter to receive further information and news tailored to you.

Darren Yates, Head of Research at Carter Jonas responds

On Thursday, 4 August, the Bank of England cut interest rates to 0.25% - the first reduction in seven years - and introduced other measures aimed at stimulating the economy post the EU Referendum vote.Darren Yates, Head of Research at Carter Jonas said that the cut would be welcome news for homeowners with a mortgage, many of whom are likely to see an immediate reduction in their monthly outgoings.

Yates said:

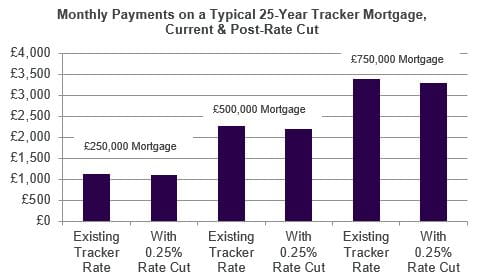

“If the 0.25% interest rate cut is passed on to borrowers in full, someone with a typical 25 year tracker mortgage of £250,000 will see their monthly payment go down by over £30. Borrowers with greater mortgages will see even larger savings. Someone with a £500,000 mortgage could see a monthly saving of over £60, while those with a £750,000 mortgage will save over £90 per month - equivalent to over £1,000 per year.

Sources: Bank of England, Carter Jonas

Analysis based on Lifetime Tracker figure as at June 2016 and assumes 0.25% cut is passed on in full to borrowers.

Sources: Bank of England, Carter Jonas

Analysis based on Lifetime Tracker figure as at June 2016 and assumes 0.25% cut is passed on in full to borrowers.

“However the lower interest rate will do little for those borrowers on a fixed rate mortgage, unless their agreement is coming to an end, in which case they would be in a position to take advantage of the current competitive mortgage market. Additionally, whilst first time buyers will benefit from lower rates, their borrowing options remain largely restricted by the Mortgage Market Review guidelines and the requirement for large deposits is still making it difficult for many would-be homeowners to get onto the property ladder.”

A number of recent surveys suggest that economic growth is set to slow, as such the interest rate cut will also support the wider economy, and this should have a direct impact on the property market. In particular, it will likely help to boost business and consumer confidence, which has softened in recent weeks.

Yates continued: “On the commercial property side, the rate cut will help to support pricing, with property yields continuing to look attractive compared with other asset classes. In particular, the lower interest rate will help to support lower-yielding prime London property, while prime office yields of around 5.25% in the UK's regional cities such as Leeds and Manchester look even better value, against a 10-year government bond trading at sub-1% as at early August.

“Moreover, the ongoing weakness of Sterling will provide an additional factor to entice international buyers back into the market, which should give a boost to activity in the coming months. Following something of a drop in activity in the run up to the EU Referendum vote, international investors have returned to the market and have been involved in a number of significant commercial deals in Q3, with the Pound still around 10% down on its pre-vote level against the major currencies.”