- Date of Article

- Mar 13 2013

Keep informed

Sign up to our newsletter to receive further information and news tailored to you.

Reflections on 2012

13 March 2013, Having taken a few weeks to reflect on last year we thought it was worth looking back at 2012 and ahead into 2013.

As far as money markets, Europe and their impact on cost of funding were concerned. 2012 proved to be quite a challenging year.

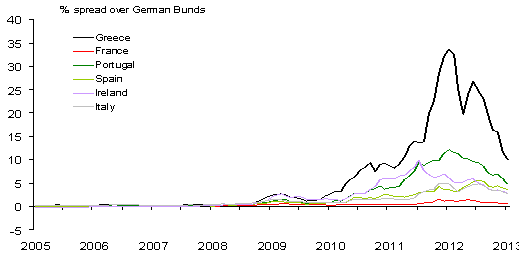

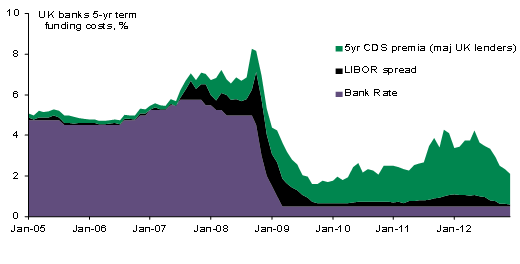

The twelve month period saw extreme price volatility driven by uncertainty in Europe, UK and the banking sector (see Chart 1 and 2 below)

Against this backdrop it is pleasing that AMC continued to lend into the agricultural sector, seeing another increase in its lending growth figures.

Chart 1 – Europe funding cost volatility

Chart 2 – Money Market volatility

Outlook for 2013

Price

Stability seems to have returned to the money markets. The Government backed Funding for Lending Scheme (FLS) seems to be working, in terms of bringing cheaper money to the market; whether it increases the volume of lending is yet to be evidenced.

Though there is no guarantee, we anticipate relatively stable pricing should be achievable throughout this year and AMC pricing is competitive in the marketplace (especially when applying discounted rates for EIB eligible projects)

Fixed rates remain relatively stable with funding costs showing a 10 to 20 basis point (0.10 – 0.20%) volatility over the last 2 months. It is worth noting that longer dated gilts (2, 5 and 10yr) have shown a gentle 'uptick' in the last 3 or 4 months. This may be a sign that rates are 'gently' on their way up. However, we would caution against over-confidence in this regard, as volatility is still with us.

A banker's view – what will farmers borrow for?

The demand for long term lending tends to correlate with long term confidence in our sector. Given the challenges that the weather, poor harvest and high input costs are currently posing for many farmers, one could argue that confidence in some sectors, and especially confidence to invest, has waned of late.

However, we would simplistically divide potential borrowers into 2 categories:

Pessimists

Many of our livestock clients will be worrying about how they will come out of an expensive winter with high feed costs and poor quality silage. Overdrafts are already coming under pressure and will increase further, especially with tax bills for the year ended March 2012 (2011 harvest) falling due.

Equally some arable farmers will have struggled through the harvest and the weather will have impacted preparations for the 2013 cropping year. They too will be relying on the overdraft finance to see them through to harvest 2013.

AMC lending can help here in 2 ways:

- Firstly – one of AMC's core messages has always been that farmers should consider re-structuring their finances when overdrafts develop a hard core element. With uncertainty around 2013 income streams, all farmers should be considering the structure of their finances and discussing this with their advisers and accountants. At a time when finance is cheaper than it has been for a decade or more, restructuring finance for the long term and relieving the pressure on the overdraft seems sensible. Some will look to their bank to assist here but it is worth remembering that AMC funding can also be a good alternative.

- Second - the AMC Flexible Facility product offers an excellent alternative for short term funding, giving certainty of credit availability for up to five years without annual reviews.

The best farms continue to innovate and improve, whilst many stagnate. It is our belief that farmers will be looking at the real cost of borrowing and at the opportunities to invest in buildings, diversification, improvements or land purchase, and deciding that rates of interest have reached a low point at which they can make a real return over the next 10 or 20 years.

AMC have recently secured a further £20m tranche of EIB discounted funds which allows them to discount already low pricing by a further 0.65% on eligible applications.

When taken together with the current historic low interest rates and the temporary rise in capital allowance threshold this could present some businesses with a real opportunity to invest cost effectively for the long term, despite the weather!

Summary

In 2012, AMC continued to be a significant provider of finance to the sector– supporting UK farming to invest and strengthen their businesses for the long term.

In 2013 many farmers will need to focus on cash management, managing credit and cash flow. Restructuring debt and properly assessing the need for working capital will be important considerations.

Others will have the strength in their business and the confidence to continue to expand and develop in order to realise the opportunities the long term positive outlook offers.

AMC can help both types of business and Carter Jonas as AMC Agent's would be very happy to have a confidential and no obligation discussion with you or your clients.

AMC Agent Contact:

Andrew Fallows MRICS FAAV

01904 558212

Andrew.fallows@carterjonas.co.uk

Dan Taylor MRICS FAAV

01904 558219

Dan.taylor@carterjonas.co.uk

Tom Whitehead MRICS FAAV

01423 707801

Tom.whitehead@carterjonas.co.uk

Carter Jonas have recently undertaken a survey to banks on their attitude towards lending to the agricultural sector. Approximately 25 responses have been recorded from banking experts throughout the UK. The analysis will be published in our Rural View publication in June. For further details please contact Catherine Penman, Head of Research on Catherine.penman@carterjonas.co.uk