Energy news - December 2025

- Grid Reform Update

- Gate 2 Impact on Project Values: What Developers and Investors Need to Know

- Market Headlines

- Showcasing Our Work: Renewable Energy Case Studies

- New starters

Grid Reform Update

Last week has seen the long-awaited start of applicants being notified by NESO about their grid submissions for both distribution and transmission level connections.

The Carter Jonas energy team was pleased to be involved in the signing of over 4GW of land option agreements for the submission into the Gate 2 window which closed on 26th August 2025. On the 1st October, NESO release an updated timeline for offer notifications with “protected” projects being notified by w/c 1st December at the latest.

Charles Hardcastle, Head of Energy and Marine at Carter Jonas, commented: “We are proud to have received a large number of positive Gate 2 notifications from our partnered developers, landowners and investors as protected offers are starting to come through. This is a testament to the partnerships, expertise and hard work that has been done by us and our partners to get these projects in the best possible state heading into the transition. We are delighted to support our clients as they progress quickly into the next development stage. We are also closely reviewing the initial results that have been published by NESO to determine where opportunities for new sites are opening up across the country where capacity has been freed up so that we can best assist in helping our partners take advantage of the window of opportunities for new projects."

Gate 2 Impact on Project Values: What Developers and Investors Need to Know

Current market context

Following recent Gate 2 notifications and updated timelines, developers are reassessing their portfolios. Grid connection dates now play a critical role in determining project viability. The ‘2030 threshold’ is a key marker:

- Projects with post-2030 dates may struggle to secure funding or progress, creating opportunities for investors with longer-term strategies.

- Projects with pre-2030 dates will require milestone and grid payments soon, increasing financial pressure but also making these projects more attractive for buyers seeking near-term delivery.

Battery Energy Storage Systems (BESS) remain a focal point. While national capacity applications exceed projected requirements, viable opportunities will be highly localised and dependent on grid access and timing.

What this means for developers

Developers face tough decisions. Many will prioritise projects that can deliver sooner, which are likely to command a premium in the market. Others may choose to sell or exit projects with delayed or uncertain connection dates to free up capital. Funding every project is unrealistic, and near-term commitments such as milestone payments increase pressure on cash flow. This dynamic is driving a wave of portfolio reshaping and transactional activity.

How Carter Jonas supports

Our Energy Transactional Services team helps developers and investors navigate these decisions by structuring deals for project sales or acquisitions and advising on market value and timing. We combine technical, commercial, and strategic insight to reduce risk and maximise asset value.

We are currently advising on the refinancing or disposal of projects ranging from operational private wire solar installations and anaerobic digestion assets to ready-to-build solar and BESS projects (25MW to 500MW), and portfolios exceeding 1GW comprising both RTB and in-development solar, BESS and wind projects.

These examples reflect our active involvement across technologies and scales, from greenfield development through to operational assets.

Why engage with us?

With over 2GW of assets transacted, representing more than £220 million in value over 15 years, Carter Jonas combines market insight with hands-on transactional experience. Our involvement in live deals means we understand pricing, appetite, and risk in real time, enabling us to deliver practical, tailored solutions in a fast-moving market.

Who to contact?

If you would like to discuss opportunities or explore how our Energy Transactional Services team can support your projects, please contact:

Stuart Campbell – Partner, Head of Energy Transactional Services

Tel: +44 7890 300094 | Email: Stuart.Campbell@carterjonas.co.uk

Will Hunt – Energy Specialist

Tel: +44 7483 448634 | Email: William.Hunt@carterjonas.co.uk

Market Headlines

Budget outcomes for the renewables sector

The Chancellor delivered the governments autumn budget on 27th November and while the overall focus was on tax, pensions and welfare, the government also announced several changes affecting the renewables sector. On the power side, the government will shift 75% of the policy costs of the Renewables Obligation (RO) from energy bills onto general taxation from 2026/27 to 2028/29 to help aid the reduction of consumer energy bills by up to £150. Nuclear power planning frameworks have been revised to allow for the faster development of new projects including Small Modular Reactors. In the transport sector, EV Pay Per Mile charges are to be introduced from April 2028 (3p/mile charge for EVs and 1.5p/mile for PHEVs) and Vehicle Excise Duty for petrol and Diesel cars will remain frozen until September 2026 after which it will rise with inflation. There was also a mini package of new support for installing EV charge points including £100m extra for home and workplace charging infrastructure (likely through grant mechanisms) and a new 10-year, 100% Business Rates relief for EV charges and EV only forecourts.

Renewables overtake coal globally for first time on record

In October, Ember insights revealed for that for the first time ever renewables overtook coal in the energy mix. In H1 of 2025 renewables saw an increase of 363 TWh (+7.7%) to bring its global total to 5,072 TWh, whilst coal fell by 31 TWh (-0.6%) to 4,896 TWh. This means that for this period renewables contributed 34.3% of the energy mix and coal 33.1%. Clean energy expansion was strong enough to meet rising global demand without increasing fossil fuel generation, signalling the worldwide shift away from coal. While hydro and bioenergy dipped, nuclear saw modest gains, and overall power sector emissions began to plateau.

Ofgem demand connection applications

On the 6th of November Ofgem responded to the recent surge in demand connection applications. These jumped from 41GW in late 2024 to 125GW by mid-2025 - data centres account for a significant share of growth in the demand queue.

Demand projects only need to meet TMO4+ readiness criteria, as there’s no ‘needed’ filter. While this avoids restricting growth, it has unintentionally caused the demand queue to exceed Ofgem's forecasts.

The regulator warns that the presence of unviable projects in the demand queue risks misallocating resources and undermining network planning, ultimately creating inefficiency across the electricity system.

Proposed measures include stricter entry requirements, progression fees, and improved transparency, alongside efforts to accelerate connections and prioritise strategic projects. Stakeholders had until 5 December 2025 to submit feedback.

NESO opens consultation on regional energy plans

On the 14th of November the National Energy System Operator (NESO) announced that it had launched a new consultation inviting customers and stakeholders in Scotland and Wales and in nine English regions to help shape the methodology that will help deliver a set of Regional Energy Strategic Plans (RESPs). These plans will form part of Great Britain’s wider strategic energy planning framework alongside the Strategic Spatial Energy Plan and the Centralised Strategic Network Plan. The consultation period will extend from 17th November 2025 to the 16th of January 2026.

The RESPs aim to improve efficiency and accelerate progress towards net zero by bringing together electricity and gas distribution network planning, which are currently separate. Feedback from the consultation will inform NESO’s final methodology, expected in summer 2026 following approval by Ofgem and DESNZ. NESO will then begin developing the first 11 RESPs.

As a team, we are look forward to seeing the opportunities generated by these plans for landowners and communities and will be here to support the strategies, both at a local and national level.

Strategic Spatial Energy Planning (SSEP) delayed

The Strategic Spatial Energy Plan (SSEP) is a framework led by NESO as a pathway to guide energy infrastructure development and support the UK's journey to net zero by 2050. The first SSEP will be a GB-wide plan, mapping potential zonal locations, quantities and types of electricity and hydrogen generation and storage. The SSEP works with and supports other important energy transition programmes, like the Centralised Strategic Network Plan (CSNP) and RESP.

However, the publication of the SSEP has been delayed due to the NESO re-running its modelling with updated data. The SSEP was initially projected to be published in Q4 2026, a new estimation is yet to be provided however, NESO have stated that it will be pushed back several months.

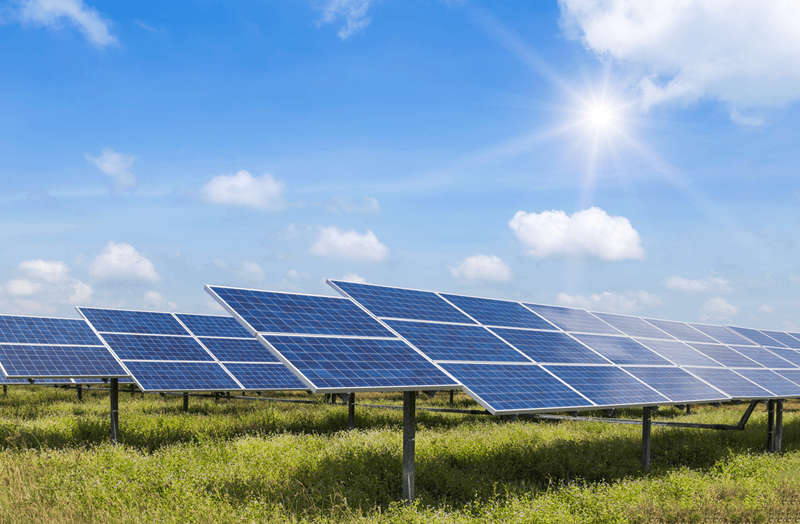

Showcasing Our Work: Renewable Energy Case Studies

Marksbury Plain Solar Farm is a 14.45MW renewable energy scheme located in near Bath, Somerset

At a glance

Site - Marksbury Plain Solar Farm

Sector - Energy

Location - Somerset

The project received planning approval from the Council’s planning committee on 29th June 2022 and was successfully energised in May 2025 following a year-long construction phase.

The scheme was developed by European Energy, a leading developer in the renewable energy sector, and is now owned by AlphaReal. European Energy continues to play an active role in the project as the retained asset manager, ensuring the long-term operational efficiency and sustainability of the site.

The solar farm contributes significantly to the region’s renewable energy generation capacity and supports national targets for decarbonisation and energy security. It is expected to generate enough clean electricity to power thousands of homes annually, reducing carbon emissions and supporting the transition to a low-carbon economy.

Carter Jonas was instructed by the landowner in May 2020 to provide strategic advice and representation throughout the development process. This included negotiating Heads of Terms, drafting and agreeing the Option and Lease agreements, and offering ongoing support under the Lease as required. The energy team worked closely with the landowner to ensure that the terms secured were commercially favourable and aligned with the long-term interests of the landholding.

The involvement of Carter Jonas helped facilitate a smooth and successful transaction, ensuring that the landowner was well-positioned to benefit from the development while contributing to the wider sustainability goals of the region. The project stands as a strong example of how landowners can partner with experienced advisors and developers to unlock the potential of their land for renewable energy generation.

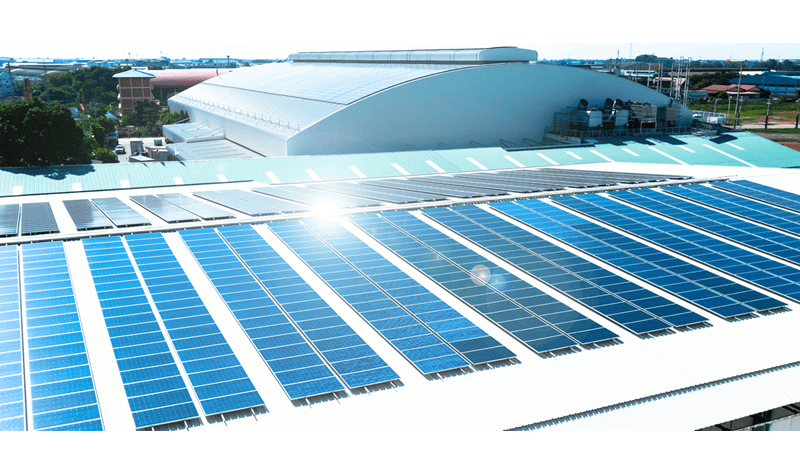

Alfreton Solar Farm is a 20MW solar scheme located north of Alfreton, Derbyshire

At a glance

Site - Alfreton Solar Farm

Sector - Energy

Location - Derbyshire

The project secured planning approval from both Amber Valley Borough Council and Northeast Derbyshire District Council in November 2021. Following a year-long construction phase, the site was successfully energised in December 2024.

The scheme was developed through a partnership between Anesco and Gresham House. Gresham House subsequently acquired the asset, with Anesco retained as the site’s asset manager, ensuring the long-term performance and maintenance of the solar farm.

In 2020, Carter Jonas was instructed by the landowner to undertake a feasibility review of their landholdings. Through this process, the energy team identified a 94-acre site adjacent to a Northern Powergrid substation as having strong potential for a large-scale solar development. Grid investigations confirmed the availability of approximately 20MW of export capacity, making the site highly viable for solar.

Following a competitive marketing exercise to developers, Anesco was selected to take the project forward. Carter Jonas acted for the landowner throughout the Heads of Terms negotiations and subsequently advised on the Option and Lease agreements. The team continues to support the landowner with any ongoing matters under the Lease.

New starters

We’re excited to welcome Tom Clements to the Energy Team. Tom joined us in December as a Senior Energy Specialist based in our Leeds office. With a strong development background, Tom has spent the last four years as a project developer at Anglian Water and Anesco, gaining extensive experience in the renewable energy sector. His expertise spans solar and Battery Energy Storage System (BESS) developments, and we’re looking forward to the knowledge and insight he brings to our projects.

Contributors

|

Charles Hardcastle 07969 354368 |

Helen Moffat

Associate Partner 07467 335587 |

Thomas Pipe

Graduate Energy Specialist 07801 167725 |